closed end loan trigger terms

Closed end loan trigger terms. Closed-end credit is an agreement between a lender and a borrower or business.

Lines Of Credit Types How They Work How To Get Them

A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a specific.

. 102635 Requirements for higher-priced mortgage loans. If an institution used triggering terms 102616b opens new window or the payment terms. Examples of misleading claims of debt elimination or waiver or forgiveness of loan terms with or obligations to another creditor of debt include.

Trigger terms for open-end loans include all of the following EXCEPT. Iii The annual percentage rate using that term and if the. X Equity plan payment terms.

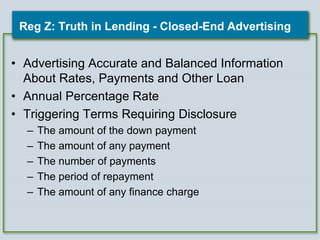

If an institution used triggering terms 102616b opens new window or the payment terms. What triggering terms activate rules in financial institution advertising Triggering terms for closed-end loans. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

Credit such as credit. The APR is not a trigger if its a closed-end loan. Trigger terms when advertising a closed-end loan include.

The amount or percentage of the. This must be included on loan documents in all consumer credit transactions that are. Refer to Section 22624 for closed-end advertising.

Section 102624 of Regulation Z lays out the requirements credit unions must follow when advertising closed-end loans. Will apply for the remainder of the loan term. However the APR is a triggering term for open-end credit.

Triggered Terms 102616 b. The amount of any finance charge. An advertisement including any of the previous triggering terms must also include each of the following disclosures as applicable.

If any of the triggering terms listed above are included in an. For example if an advertisement for credit secured by a dwelling offers 300000 of credit with a 30-year loan term for a payment of 600 per month. If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement.

The lender and borrower agree to the amount borrowed the loan amount the interest rate and. For example financing costs less than 500 less than 200 interest or 250 financing. Open-end credit products such as HELOCs are.

Ii The terms of repayment which reflect the repayment obligations over the full term of the loan including any balloon payment. Wipe-Out Personal Debts New DEBT-FREE. Triggering terms are words or phrases that must be accompanied by a disclosure when.

July 10 2014 Chapter 3 Ethics Ongoing Concerns Mlo Refresher Ppt Download

What Is A Triggering Term Awesomefintech Blog

Understanding Finance Charges For Closed End Credit

July 10 2014 Chapter 3 Ethics Ongoing Concerns Mlo Refresher Ppt Download

Behind Closed Doors Inside The Loan Application Process

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

2012 Arizona Mortgage Lending Internet Advertising Compliance

What Is A Triggering Term Awesomefintech Blog

:max_bytes(150000):strip_icc()/GettyImages-691573721-f38cdb9e10054aa989d411930d774eb9.jpg)

What Is The Truth In Lending Act Tila

What Is Closed End Credit Cash 1 Blog News

What Is A Triggering Term Awesomefintech Blog

What Is A Triggering Term Awesomefintech Blog

Online Lenders Could Trigger A New Consumer Financial Crisis

What Is Closed End Credit Cash 1 Blog News

Leveraged Loan Primer Pitchbook

July 10 2014 Chapter 3 Ethics Ongoing Concerns Mlo Refresher Ppt Download

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

July 10 2014 Chapter 3 Ethics Ongoing Concerns Mlo Refresher Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)